Easy Online Investing with the Guidance of a Financial Advisor

Online Investing, Personalized for You

Invest for your future with a digital investment platform that combines the benefits of a personal financial advisor with sophisticated technology. Through our Guided Wealth Portfolios investment platform, you get our experience and expertise with the added convenience and transparency of a 24/7 digital investing solution.

Guided Wealth Portfolios is our digital investing solution that allows you to invest online with a low starting minimum and low-cost, exchange-traded funds (ETFs) while working with a personal financial advisor. While other digital investing solutions, or robo advisors, offer online investment management, many do not include a direct personal relationship with a financial advisor—unless you’re willing to invest substantial amounts.

With Guided Wealth Portfolios, no matter how large or small your investment amount, you get a personal advisor dedicated to you and your goals. All you need to get started is $5,000* to invest. Whatever your investment goals, we can help you.

What You Get

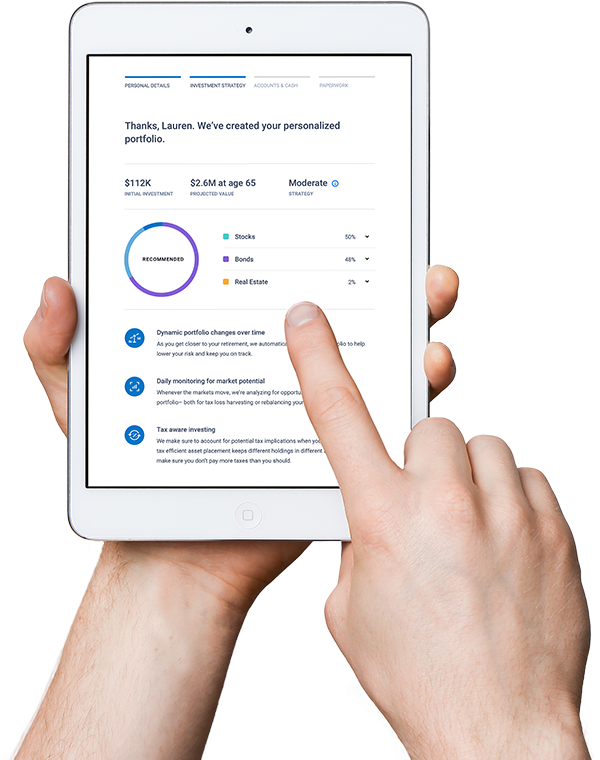

With Guided Wealth Portfolios, you get a diversified portfolio personalized for you and your individual investment goals. Guided Wealth Portfolios is an innovative way to invest for your future, whether you want to invest for retirement or a major purchase like a new home—or simply want to get your money in the markets so it’s not sitting idle. You will also get to build a relationship with a financial advisor and engage with a personalized, online dashboard that shows you how your account is doing along the way.

To see if Guided Wealth Portfolios could be the right investing solution for you, click on the link below, where you can answer a few brief questions about your goals and receive a personalized proposal.

Start Now Click “Start Now” to Get Your Personalized Proposal to See If Guided Wealth Portfolios Is Right for You!

Start Now Click “Start Now” to Get Your Personalized Proposal to See If Guided Wealth Portfolios Is Right for You!

How To Get Started

Step 1: Visit www.lplguidedwealth.com/advisor/AFS.

Step 1: Visit www.lplguidedwealth.com/advisor/AFS.

Provide an email address, and choose a password so your information is protected and tell us a little but about you.

Choose an email address you check regularly! You will get updates on how your portfolio is doing.

Step 2: Help us understand what you want for your investment account by answering a few questions about your goals and preferences.

In general, the longer you have until your goal, the more aggressive your investment strategy should be.

In general, the longer you have until your goal, the more aggressive your investment strategy should be.

Step 3: Receive your customized proposal!

Step 4: Link a current investment account or decide to fund your new Guided Wealth Portfolios account with cash from your bank account.

Step 5: Sign your digital enrollment documents via DocuSign, and let Guided Wealth Portfolios do the rest!

In most cases, you will be able to complete Guided Wealth Portfolios account opening online via DocuSign. Sometimes other steps will be required based on how you want to fund your account. Guided Wealth Portfolios will walk you through!

In most cases, you will be able to complete Guided Wealth Portfolios account opening online via DocuSign. Sometimes other steps will be required based on how you want to fund your account. Guided Wealth Portfolios will walk you through!

Start Now Click “Start Now” to Get Your Personalized Proposal to See If Guided Wealth Portfolios Is Right for You!

If you like your Guided Wealth Portfolios proposal and want to begin working with Altitude Financial Services while enjoying the convenience of online investing, you can choose to open an account immediately. You will have the option to transfer an existing investment account or fund your account with cash—it is just that easy. We implement your personal portfolio using proven diversification techniques and sophisticated algorithms. You will receive allocations designed for you and your savings goals, and benefit from trading techniques that can help reduce taxes. Your portfolio is monitored daily, keeping it on track as markets move, and rebalancing it as needed.

|

Intelligent Investing Tax-Efficient Investing: Through advanced asset analysis, we will allocate your assets in a tax-efficient manner and evaluate the tax impact of each trade before it goes through. Consistent Monitoring: Your portfolio is monitored daily, keeping it on track as markets move and rebalancing it as needed. Tax-Loss Harvesting: If an investment experiences a loss, we may sell it to offset taxable gains in your portfolio. The investments sold are replaced by similar investments to maintain your asset allocation, so you get tax benefits while keeping a properly diversified portfolio. Financial Advice: We are available any time you have a question about your account or investing strategy. Who Does What? The Portfolio Designer: LPL Research, an experienced money manager, chooses the investments for the portfolio models. Altitude Financial Services: As your advisor, we review your suggested portfolio allocation to make sure it is right for you. When your goals or life change, we are available to help you determine if your Guided Wealth Portfolio will continue to be the right solution for you. The Technology: Sophisticated algorithms are built into the technology. They examine your portfolio every day to see if it can be optimized. These algorithms can trigger rebalancing or tax-loss harvesting to ensure your portfolio stays in line with your goals, creating opportunities to help you save on taxes. Guided Wealth Portfolios Investment Process |

IMPORTANT: The projections or other information generated by Guided Wealth Portfolios regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Guided Wealth Portfolios (GWP) is a centrally managed, algorithm-based investment program sponsored by LPL Financial LLC (LPL). Guided Wealth Portfolios uses proprietary, automated computer algorithms of FutureAdvisor to generate investment recommendations based upon model portfolios constructed by LPL. FutureAdvisor and LPL are non-affiliated entities. If you are receiving advisory services in GWP from a separately registered investment advisor firm other than LPL or FutureAdvisor, LPL and FutureAdvisor are not affiliates of such advisor. Both LPL and FutureAdvisor are investment advisors registered with the U.S. Securities and Exchange Commission, and LPL is also a member of FINRA/SIPC.

There is no assurance that Guided Wealth Portfolios are suitable for all investors or will yield positive outcomes. The purchase of certain securities will be required to effect some of the strategies. Investing involves risks including possible loss of principal. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification and asset allocation do not protect against market risk.

References to tax strategies that the Guided Wealth Portfolios service investment management considers in managing accounts should not be confused with tax advice. LPL Financial does not provide tax advice. Clients should consult with their personal tax advisors regarding the tax consequences of investing.

Rebalancing a portfolio may cause investors to incur tax liabilities and does not assure a profit or protect against a loss.

This research material has been prepared by LPL Financial.